The post Four policy pillars that will encourage online micro-businesses appeared first on GoDaddy Blog.

As the U.S. rides out the COVID-19 pandemic’s economic storm, one often overlooked group has emerged as critical ballast for local communities: online micro-businesses.

As stay-at-home orders crippled economies, 44% of these micro-businesses moved more of their business to the internet, ramping up their e-commerce efforts and other digital offerings. By the end of July, less than 2% of them had closed permanently. It’s little surprise then that communities with more micro-businesses lost fewer low-income jobs at the peak of the crisis

These results come from the Venture Forward initiative, a multiyear research project that looks at the economic impact of the 20 million websites with domain names registered with GoDaddy. Three-quarters of these ventures are commerce-driven micro-businesses. The rest are community, civic or hobby-based sites.

Working with academic partners, Venture Forward has found:

- Micro-businesses create jobs. Economists at UCLA Anderson Forecast determined that there’s a causal impact between the number of ventures in a community and the number of employment opportunities, both full-time and part-time. This remains true even after controlling for 16 other economic growth factors, such as the presence of a successful local company or an inordinate number of people with graduate degrees.

- Counties with more ventures per 100 people — a measure called venture density — have lower unemployment and recovered better from the Great Recession of 2008.

- Adding one highly active venture that has more links, traffic and features like payment portals per 100 people can increase a county’s average household income by 10%, or more than $400 over a two-year period.

“Just adding a few ventures per 100 people, even if they’re small, has a significant impact,” says Karen Mossberger, a professor at the University of Arizona and one of GoDaddy’s academic research partners on the Venture Forward project.

Digital micro-businesses have been providing these economic benefits without much help from policymakers. For instance, during the pandemic, only 24% applied for Payroll Protection Program loans from the federal government, according to a GoDaddy survey of 2,330 micro-business operators conducted in July.

About 70% of small businesses applied, according to the National Federation of Independent Business.

“It’s in the interest of communities for local governments to help people get the resources they need to be successful,” says Mossberger. “And it’s low-hanging fruit, in terms of the amount of investment this requires.”

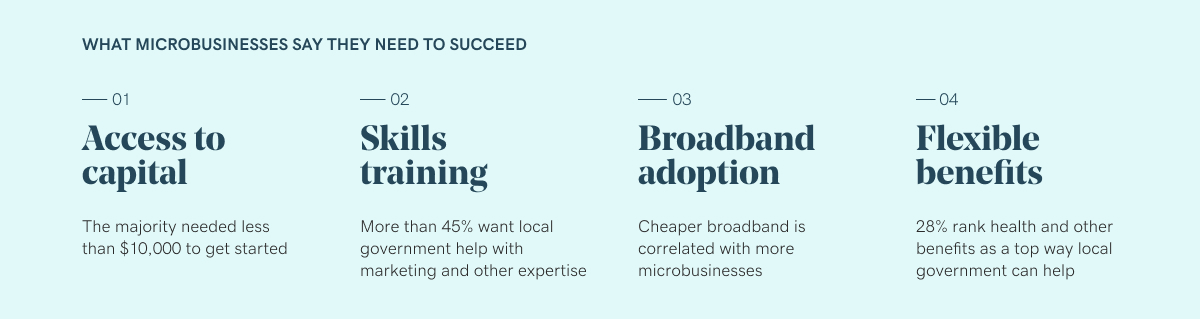

Here are four ways policymakers can help.

Access to micro-loans for micro-businesses

Most micro-businesses require very little start-up capital. According to the recent GoDaddy survey, 46% needed less than $5,000 in funding to get off the ground. But that doesn’t mean they don’t need financial help to grow.

In fact, more micro-business operators (33%) identify access to capital as the No. 1 resource they need to be able to grow right now. More than half said it was one of the top three things local governments should work on to help micro-businesses succeed.

Some credit unions are hoping to fill the void. According to a recent report by pymnts.com, a news site devoted to the payments industry, 41% of credit unions plan to add features specifically geared to micro-businesses over the next three years.

In Oregon, for example, four local credit unions plan to offer individual micro-business loans of between $2,500 and $12,500.

Municipalities are also stepping up. In Denison, Texas, local leaders, inspired by GoDaddy’s research data, created an e-commerce accelerator. It has awarded grants of up to $6,000 to 10 local businesses to help them establish an online presence or expand existing efforts.

“We had to figure out what we could do as a community to help them become more active online and market resilient,” Matt Looney, chairman of the Denison Development Agency, said while announcing the grants. “The accelerator program provided new arrows to the business quiver.”

One recipient of the Denison grants is Tamie Odom, an artist and owner of Sparrows Gallery.

Since opening in 2015, she’d sold art and art supplies, and hosted classes and free community events. Odom was forced to close her store for three months as a result of the pandemic and was thinking of shutting down permanently. Then she heard about the grant program; the extra funds helped change her mind.

“When you’re ready to close the doors and suddenly get all this support, it’s like manna from heaven,” says Odom, who is using the funds to update her gallery’s website with much-improved e-commerce capabilities and to do her first serious online-advertising campaign.

“I think we’ll meet or exceed our revenues for last year, even though we’ve only been open for three months,” she says.

Skills training and marketing support to get the word out

Micro-business operators also cite skills training as a top need. And while there are a variety of technical areas where they could use help, one area stands out: marketing. In the GoDaddy survey, 31% rank marketing as their biggest challenge to either starting or growing their company.

That support can take many forms. It can be from teaching the basics of brand-building to how to execute a sophisticated social-networking campaign. “It’s amazing what you can take away from a 30-minute conversation” with a marketing professional, says Jim Masterson, who attended bimonthly classes at a local community college with his wife as they were building a business around his unique method for massaging show horses.

While entrepreneurs can find programs to help them write a business plan or apply for a loan, getting help carving out a niche in the crowded online world is rare. Only a quarter of private-sector programs aimed at micro-business entrepreneurs include classes on sales and marketing, according to Stacy Cline, GoDaddy’s director of corporate responsibility and sustainability.

Targeted government programs can help close the skills gap, in marketing and other fronts.

In Gilbert, Arizona, a 260,000-person suburb southeast of Phoenix, the Office of Economic Development has initiated several policies to support micro-businesses. It has extended a public-private partnership that provides marketing funds to small businesses to also include ventures, as well as a pilot program to offer technical assistance and training.

The town is also looking at ways to help micro-businesses network with financial backers, suppliers and local media influencers.

Broaden the broadband

For years now, policymakers have understood that broadband internet availability generally improves the health of local and national economies, driving job creation and boosting gross domestic product.

Now, GoDaddy’s academic partners at the UCLA Anderson Forecast have found a correlation between the availability of affordable broadband and the number of micro-businesses in a community. Specifically, a $1 decrease in the price of the cheapest available broadband plan is associated with a 1.4% increase in the number of ventures.

“The cheaper you can get an extra 25 megs, the more ventures there will be.” ~Leila Bengali, economist, UCLA Anderson Forecast

Most public support for broadband deployment comes from the federal government, such as the recently approved, $20.4 billion Rural Digital Opportunity fund. That fund, according to a report by the advocacy group Broadband Now, can help provide broadband to the nation’s estimated 42 million households that don’t yet have it.

But the lack of actual connectivity is only one element of the problem.

Even when service is available, it may be too expensive or the venture owner may lack the technical comfort level to put it to use. The UCLA team is also studying how the availability of software tools can make it easier for micro-business owners to create, monitor and improve their sites.

“We should be having more of a policy argument about how to create more broadband assets to help micro-businesses,” says William Yu, a veteran economist on the Anderson Forecast team and a professor at the UCLA Anderson School of Management. “That’s the right direction for the 21st century.”

Rising interest in flexible benefit

It’s risky starting any business, no matter the cost. However, it’s even riskier if forced to do so without the traditional safety net of a benefits package. That means things like paid leave, employer-sponsored health care, retirement contributions and disability insurance.

The issue is crucial for micro-businesses: 28% of GoDaddy’s survey respondents ranked health and other benefits — both for themselves and for their employees — as one of the top three issues that policymakers could take on to help micro-businesses like theirs be successful. More than half (54%) of micro-business operators are sole proprietors, according to the survey.

Currently, 25% rely on their business as their main source of income. But roughly a quarter of the 35% who say their venture provides supplemental income today hope to make it their main business in the future.

The most discussed solutions are so-called portable benefits. The Aspen Institute, which has studied the issue, has outlined a plan: Workers would own their benefits and take them from job to job; companies would make contributions to a worker’s benefits plan based on how much he or she works for them; and benefits would cover independent workers, not just traditional employees.

There are some signs of movement on this front. In July, members of the Senate Finance Committee introduced legislation to establish a $500 million emergency portable benefits fund for states.

It would require the U.S. Department of Labor to administer the funds to states to assist them with setting up a portable benefits program for independent workers.

States like California, Washington, New Jersey, and New York are also considering some form of a portable benefits plan.

As the Aspen Institute noted in a 2016 study, “We should ensure that all workers, regardless of employment classification, have affordable access to a safety net that protects them when they are sick, injured, and when it is time to retire.”

The more local, the better

Regardless of the many challenges facing micro-businesses, experts agree that local governments are best equipped to help.

That’s because many of their problems require the help of the hands-on variety, from how to get necessary permits or help finding affordable office space.

Of course, local policymakers face many problems they can’t fix — say, U.S. healthcare reform, or budget constraints that prevent ambitious grant programs. But they can help in other ways, such as by creating networking opportunities for micro-business owners to connect with potential investors and partners, or awards programs to celebrate local success stories and their contribution to the community.

“Local governments can’t solve many of the problems venture owners face,” says ASU’s Karen Mossberger, “but they can and should be a voice for them.”

The post Four policy pillars that will encourage online micro-businesses appeared first on GoDaddy Blog.